The following data comes form PwC’s recently released annual BC mining survey, which uses input from 37 of BC’s biggest mining companies

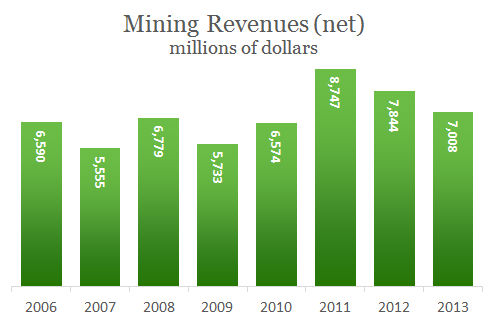

Sector hit hard by falling prices

Falling prices for important commodities produced by BC mines have led to declining revenues in the last two years. Drops in the global prices for metallurgical coal, copper, silver and gold have hit BC miners particularly hard

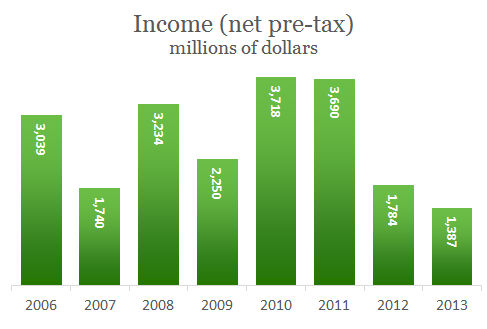

Company incomes down

Declining revenues in the last few years have taken a particularly big hit out of company profits.

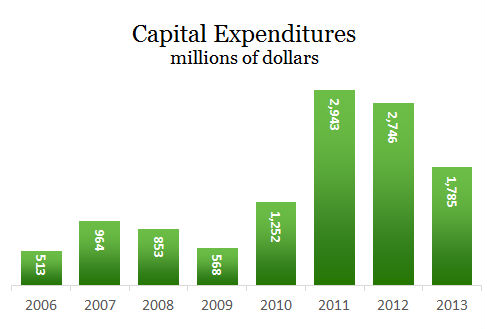

Miners controlling spending

Loss of revenue has led BC miners to cut down on their capital spending in order to conserve cash. However, they still invested considerably more in 2013 than they have earlier in the decade. Most of that spending went to surface construction and equipment.

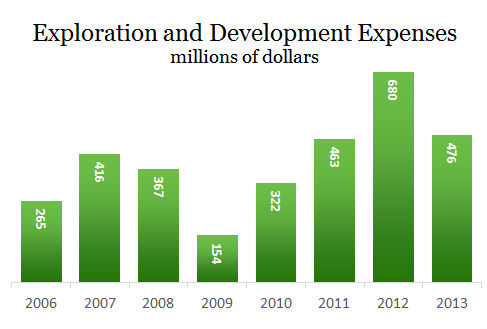

And they keep exploring

Similarly, the loss of company profits does not seem to have significantly slowed down spending on exploration and development, at least not compared to the rest of the decade.

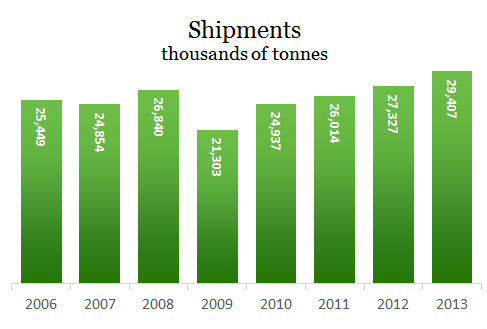

Production keeps growing

Despite falling prices, BC miners have steadily increased their overall shipments since 2009. Prices may not be as good as they once were, but BC miners are still moving a lot of minerals.

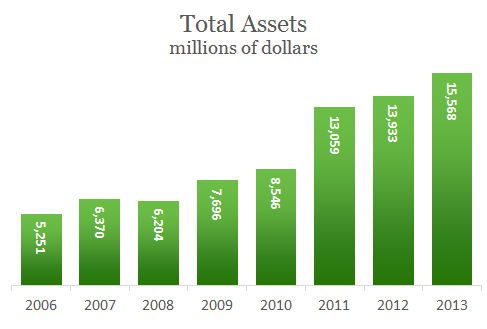

New mines spur activity

While BC miners are clearly facing big challenges on the financial side, there appears to be a strong appetite to discover and develop new mines. The increase in total assets is largely a reflection of development and production at two newer BC mines, Mount Milligan and Red Chris.

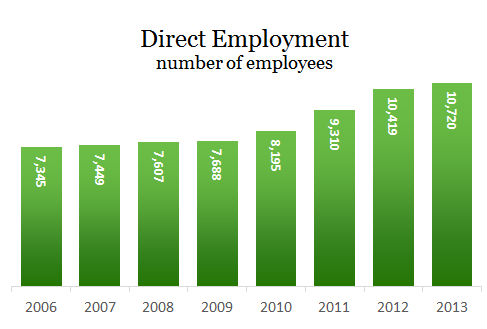

Creating more and more jobs

Perhaps the strongest illustration of BC miners staying active in tough times is the employment picture. The number of workers directly employed by BC mining companies has increased steadily over the full eight years shown in these figures.