From job creation and First Nations partnerships to the key geographic advantage of two coasts and the drive to capture premium pricing, LNG stands out as a major opportunity for Canada. Record-breaking regasification expansions and carrier orders globally illustrate that investors see LNG as a long-term bet. By developing its own complete “well-to-customer” LNG value chain, Canada can boost its economy, earn fair value for its natural resources, and fortify its standing among the world’s top energy-exporting nations.

1. Solid, Long-Term LNG Demand

- Major Forecasts:

- IEA (World Energy Outlook 2022): Projects global natural gas (including LNG) demand to remain significant through at least the 2030s.

- Canada Energy Regulator (Energy Futures): Highlights Asia’s growing appetite for LNG, suggesting Canada can capture new market share.

- U.S. EIA (International Energy Outlook): Foresees a continued rise in LNG trade despite energy transition efforts, underscoring natural gas’s enduring role.

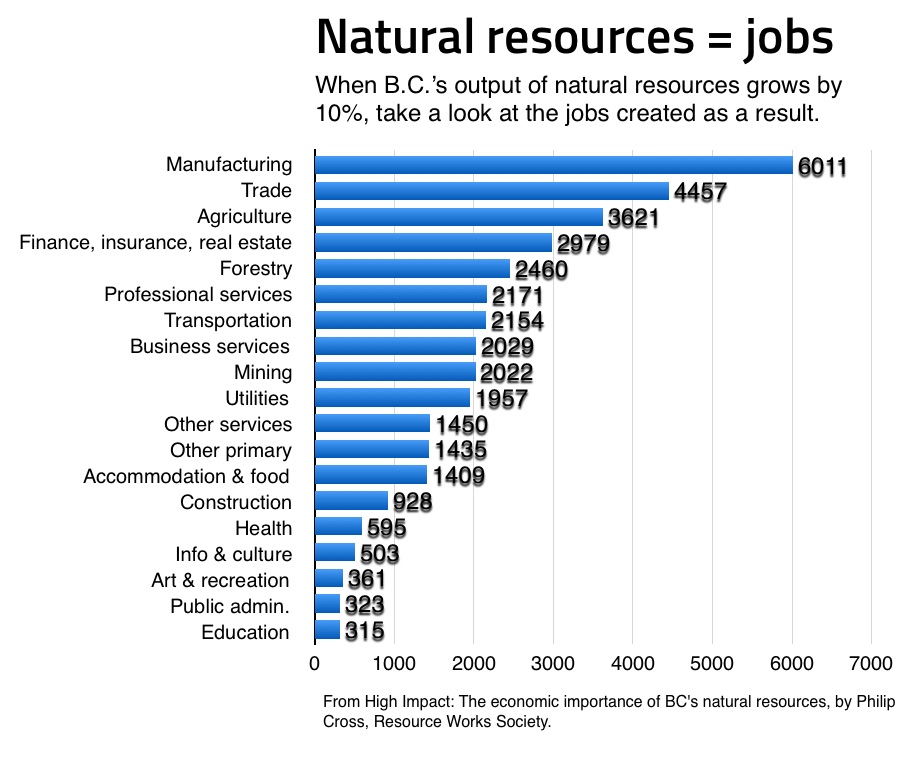

2. Massive Job Creation

- Range of Roles: Construction, trades, operations, logistics, engineering, and management.

- Resource Works estimates: BC LNG projects alone could generate tens of thousands of direct and indirect jobs.

- Ongoing Operations: Facilities typically run for decades, supporting long-term employment.

3. Reliable, Long-Term Revenue

- Public Finances: Corporate taxes, royalties, and income taxes at all levels of government.

- Stability: LNG terminals operate for 20+ years, providing predictable revenue streams.

4. First Nations Partnerships

- Shared Prosperity: Equity stakes, revenue sharing, training programs.

- Community Development: Economic autonomy and long-term growth opportunities.

5. Proof of “Smart Money”: Regasification & Carrier Fleet

- Regasification: Global capacity reached 1,010 MTPA in 2022 (GIIGNL).

- New Projects: 20+ terminals under construction or near FID, adding 100+ MTPA by 2026.

- Carrier Fleet: Over 700 active LNG vessels; 182 new ships ordered in 2022, with 300+ under construction.

Key Insight: Massive investments signal strong investor confidence in LNG’s long-term future.

6. Two-Coast Geographic Advantage

- West Coast: 8–10 days to Asia (vs. 20+ from U.S. Gulf, 14+ from Middle East).

- East Coast: 6–8 days to Europe.

- Strategic Edge: Faster routes mean lower costs, less boil-off, more competitive pricing. Only Russia rivals Canada’s dual-coast access.

7. Market Preference for Reliability

- Buyer Priorities: Stability and security of supply.

- Canada’s USP: Political stability, regulatory integrity, and geographic advantage.

8. Ample Natural Gas Reserves & Tech Efficiency

- Top-Tier Holdings: Major reserves in Western Canada.

- Efficiency: Technological advancements in extraction and pipeline operations.

9. Rigorous Regulatory Environment

- High Standards: World-class environmental and project oversight.

- Social License: Mandatory consultation builds local support and reduces project risk.

10. Diversification & Economic Resilience

- Spillover Effects: Benefits to engineering, marine services, tech R&D, logistics.

- Economic Stability: Adds strength alongside oil, minerals, and forestry exports.

11. Technological & Engineering Leadership

- Innovation: Advanced liquefaction, leak detection, and terminal designs.

- Global Competitiveness: Competing with Qatar, Australia, U.S. drives innovation.

12. Community & Infrastructure Development

- Local Upgrades: Roads, ports, broadband, and utilities.

- Workforce Training: Skilled trades development and certification programs.

13. Lessons from Other LNG Heavyweights

- Qatar: Top global LNG exporter; massive national wealth.

- Australia: Rapid build-out, job creation, and GDP growth.

- U.S.: From LNG importer to exporter in under a decade.

- Common Denominator: All continue to expand LNG infrastructure.

14. Price Disadvantage of Selling Only to the U.S.

- Market Control: U.S. buyers set the price for Canadian gas—far below global LNG value.

- Lost Value: Americans convert Canadian gas to LNG and capture the premium.

- Made-in-Canada Solution: Building our own LNG infrastructure keeps value here.

15. Large Projects’ Impact on GDP: Trans Mountain Comparison

- Proven Effect: TMX completion brought immediate GDP uplift.

- Next in Line: LNG Canada’s first export cargo—expected within weeks—will repeat the boost.

16. Navigating Commodity Cycles

- Volatility is Normal: Price swings are part of energy markets.

- The Trend is Clear: Long-term forecasts still strongly favour LNG demand.

17. Platform for Future Energies

- Carbon Capture & Hydrogen: Existing LNG infrastructure can pivot.

- Future-Proofing: Pipelines and ports can support Canada’s evolving energy mix.