If you doubt there’s a future for clean, democratic oil and gas, look at Norway.

The real question is: can Canada get its act together?

Before we look to the future, let’s examine, at a macro level, the success of Norway’s prioritization of oil and gas production from the standpoint of prosperity, quality of life, and environmental stewardship.

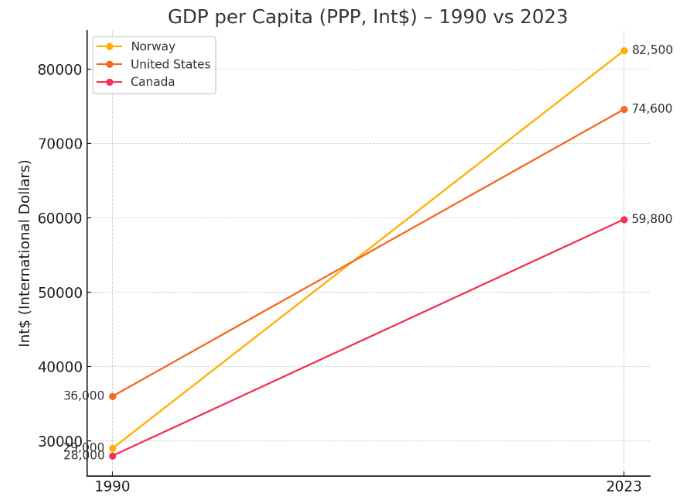

First, GDP purchasing power parity (PPP). It shows how much people in each country can afford after adjusting for local prices and living costs.

Comparison of GDP (PPP) for Canada and Norway in 2023.

| Country | GDP (PPP) per Capita (Intl $) | Population (approx.) | Total GDP (PPP) |

| Canada | $59,800 | 41 million | $2.5 trillion |

| Norway | $82,500 | 5.5 million | $500 billion |

The chart below, sourced from Our World in Data, shows that in 1990, Canada and Norway were virtually tied in GDP per capita (PPP), with Norway approximately $1,000 ahead. By 2023, the gap had widened to $22,700—a 2,170 percent increase. The United States is included for additional context.

Second, the Human Development Index (HDI), published by the United Nations Development Programme, measures a country’s average achievements in three basic dimensions of human development: a long and healthy life (life expectancy), knowledge (education), and a decent standard of living (income).

Canada ranked 3rd on the Human Development Index in the early 1990s but has since fallen to 16th, while Norway now holds 2nd place. Full rankings and historical trends can be explored at the UNDP’s interactive Country Insights dashboard.

Third, domestic emissions success.

- Norway leads the world in EV take-up, including in Arctic regions. In Canada, ZEV vehicles reached 13.8 percent of total sales in 2024. BC and Quebec have significantly higher numbers than the national average.

- Norway leads the world in per capita public fast EV chargers with 27,000 (400 per 100,000 persons) public rapid charging points (context: BC Hydro is targeting 800 by the spring of 2026).

- According to the International Energy Agency (IEA), Norway leads the world in methane leakage reductions in oil and gas operations. However, the Pembina Institute reports that BC is also a leader among major natural gas suppliers.

- According to Our World in Data, Norway’s national electricity grid had a carbon intensity of 31 g CO₂/kWh in 2024. British Columbia, a subnational region, recorded approximately 13 g CO₂/kWh in 2020, according to the Canada Green Building Council, placing it among the cleanest electricity systems in the world.

(*CO₂/kWh = grams of carbon dioxide per kilowatt-hour of electricity produced).

Like BC, Norway has a lot of hydroelectric power. Norway also experiences a rise in grid emissions in years when reservoirs are low, and electricity must be imported from sources with higher CO₂ emissions.

As energy security has become a national security concern, Norway has been able to assist the European Union and NATO allies in addressing this threat rapidly. Norway ramped up natural gas deliveries and used its hydro-powered grid to export electricity through undersea cables.

How does Norway view its future in the oil and gas industry?

Norway, which has relatively limited oil and gas reserves, is planning a managed decline in oil production while continuing to explore more oil and gas. The intention is to extend its presence in the global energy market, as outlined in the REPowerEU Actions between the EU and Norway. This is not a plan to exit the oil and gas market, but to extend Norway’s presence in it.

Canada doesn’t have the constraints of Norway. Canada is the fifth-largest oil producer and holds the third-largest reserves, with access to European, North American, and Asian markets.

Canada, Norway, and the EU have similar regulatory frameworks. As in Canada, there is a high-profile debate and push-back in the EU about protecting both consumers and industries from the unintended side effects of carbon pricing and how that money is to be utilized.

What to do now in Canada after 80 percent of the electorate voted in favour of a singular message: Canada’s natural resources and oil and gas in particular. We can assume that most of those voters envisioned a future similar to Norway’s, characterized by responsible resource development and prosperity.

It will not be easy. What sets Norway apart from Canada is that when its industry began to develop at the same time as Canada’s Oil Sands, it quickly gained broad public support. On the other hand, Ottawa and Alberta have been divided.

Norway has one significant advantage. Norway has one government, there are no sub-national jurisdictions. Immigration has not been a factor until recently. Norway is engaged in reconciliation with its sole Indigenous nation, the Sámi, who have rights to a specific territory in northern Norway, and there is no history of colonization.

As we all know, Canada is divided—thirteen provincial and territorial governments control resources, the federal government oversees trade and infrastructure, it is a bi-national state, immigration has always been a factor, and more than 600 Indigenous nations claim “Rights and Title” over lands throughout the country.”

The backbone of Norway’s unity is its Sovereign Wealth Fund. The Constitution Act and Indigenous reconciliation would make it impossible to negotiate such an arrangement in Canada

In Canada, when a national priority arises, we often resort to Crown Corporations, where there is no private interest, or P3s, where there are still no investors—just contractors and potential rent collectors.

The most successful option has been the federal port authorities, which can raise their own financial capital. Again, there are no private investors.

Norway took a different approach. It holds a 65 per cent stake in Equinor, Norway’s largest oil and gas company, and maintains ownership in other major ventures. Equinor is listed on both the Oslo Stock Exchange and the New York Stock Exchange. The effect is a regulatory political system that balances the expectations of domestic and foreign investors.

This direct involvement gives investors confidence: if they meet emissions targets and regulatory goals, they can expect timely approvals and stable rules. In return, the public and government have a reason to support success.

There are no easy answers for Canada, but we must find our way. In the 1980s and 1990s, Canada’s political right leaned toward market-oriented policies, while the left leaned toward democratic socialism. Perhaps, in this moment of crisis, we can rediscover the middle. It worked for Norway, and much of Europe may now be heading in that direction.

It’s worth considering, especially given the damage done to investors’, workers’, and stakeholders’ confidence. Broadening public ownership in privately owned projects may be a path to stability, giving all open-minded stakeholders and investors a reason to engage.

Jim Rushton is a 46-year veteran of BC’s resource and transportation sectors, with experience in union representation, economic development, and terminal management.