There is some bitter irony that, at a time when natural gas prices in Western Canada are at historic lows, the good folks of Kitimat are facing some eye-watering increases in their natural gas bills.

Kitimat, after all, is the epicentre of B.C.’s new LNG export industry.

From Prince Rupert to Dawson Creek, Pacific Northern Gas customers are facing some steep increases on their natural gas bills over the next three years, with PNG-West customers (Kitimat, Terrace, Prince George, Vanderhoof) facing the stiffest hikes.

Which raises the question: Will LNG exports increase the price of natural gas for homeowners and businesses in B.C? Let’s hope they do, because at current prices, we are giving it away, and the B.C. government is losing hundreds of millions in natural gas royalties. But the rate increases faced by northern B.C. gas customers have nothing to do with natural gas prices — it’s all about the cost of maintaining delivery infrastructure. The BC Utilities Commission (BCUC) recently approved interim hikes for basic and delivery rate charges representing a 61% increase over three years for PNG-West customers. When the elimination of the carbon tax is factored in, this represents total bill increases of 32.9% over three years.

The average residential customer in the PNG-West service area will pay $23 a month more this year, according to PNG. Over three years, they will pay a total of $596 in additional costs, the BCUC confirms. The average small business customer will pay monthly increases of $88, according to PNG. Dawson Creek, Fort St. John and Tumbler Ridge likewise face increases, though not as steep as their neighbours in the northwest. (See here for residential rates for each community.) Don’t be surprised if the anti-fracking crowd pounce on these increases as evidence that B.C.’s LNG industry will lead to energy poverty by raising the price of natural gas in Canada. But the rate increases that northern B.C. customers are facing are not about the price of gas. They are about the price of building and maintaining the storage and delivery network to get it from the processing plant to the home or business.

Gas is cheap, delivering it is expensive

In B.C., the cost of gas represents only about 12% to 16% of your total bill, depending on who your provider is. The lion’s share of a natural gas bill is delivery (i.e. pipelines, compressors, etc.), storage and transportation charges. According to PNG, the increases are needed to maintain its system, as it has faced higher operating costs, lower demand and “the need to recover deferred costs.”

Over the years, PNG has lost major industrial customers, including the Methanex plant in Kitimat, as well as sawmills that are now shuttered, and its delivery system is now operating at only 20% of capacity, according to the Northern Sentinel. So residential and business customers are now being asked to share more of the burden to keep the whole system running.

Understandably, city councils in Kitimat and Terrace are pushing back on the increases, and are appealing to the provincial government to intervene. So what about LNG and natural gas prices? The anti-fossil fuel lobby has lately been warning that Western Canada’s nascent LNG industry is about to send natural gas prices skyward.

In an opinion piece in the Globe and Mail earlier this week, Mark Ogge of the Australia Institute warns that natural gas prices in Australia have tripled since 2015, after large LNG export terminals went into production.

Could LNG exports triple natural gas prices? Let’s hope so.

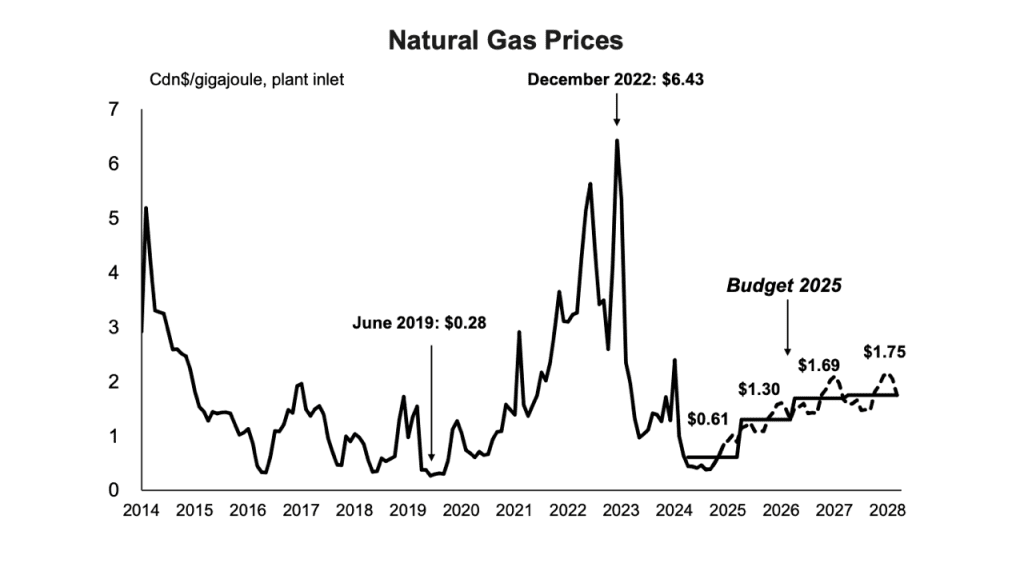

At today’s prices, if B.C. natural gas prices tripled, producers would still be getting just a little over $2 per MMBtu, which is half the price of Henry Hub gas in the U.S. — about $4.26 per MMBtu (US$3.11). The current spot price for natural gas at Station 2 (B.C.’s trading station) is $0.73 per MMBtu. When you are measuring natural gas prices in cents, not dollars, it means you are way over-supplied, practically giving the stuff away, and the province is losing millions in royalties. On average, in 2024 and 2025, natural gas prices in B.C. have been $0.61 per MMBtu, according to the 2025 BC Budget, which, incidentally, forecasts natural gas prices will rise to a meagre $1.75 per MMBtu by 2027. Both the U.S. and Western Canada have oceans of natural gas.

Gas so abundant and cheap in North America that, to fetch a proper world price, you need to liquefy it and ship it off somewhere, like Europe, where prices are US$11.40 per MMBTu, or Asia, where the price is US$12.07 per MMBTu. So will LNG exports increase natural gas prices in Canada? Hopefully. That’s kind of the whole point of developing an LNG export industry – to get better prices for our natural gas. But it may take a few years.

A recent Deloitte report forecasts LNG exports will eventually lift natural gas prices in Canada, but it’s going to take a while, because we already have a surplus. “Despite uncertainties in oil markets, the commissioning of the long awaited LNG Canada export facility has sparked optimism that the era of extremely low Canadian gas prices compared to Henry Hub, may finally end,” Deloitte says. Deloitte notes that LNG Canada, Woodfibre LNG and Cedar LNG could increase demand for natural gas by 2.5 bcf/d. That represents about 13% of Canada’s current total production of 18.9 bcf/d. Add in LNG Canada Phase 2, and Ksi Lisims, and that would bring the total demand up to 5.9 bcf/d, or 32% of Canada’s current production.

Some of the gas we currently export to the U.S. could end up fetching a much higher price in Asia. “This added demand for natural gas is expected to support increased gas prices in Alberta and British Columbia,” Deloitte says. “However, if basin growth continues at the current pace, Deloitte’s analysis is that this demand may be fulfilled within a few years.”

In B.C., natural gas is a byproduct

Much of the natural gas produced in B.C. is a byproduct of natural gas liquids production. The real value in the liquids-rich Montney is the condensate, which fetches nearly the same price as oil, and propane. Ian Archer, North American natural gas market expert for S&P Global, points out that wet gas (condensate, propane, etc.) makes up only about 15% to 20% of production, with dry gas making up about 80%. “You basically take a loss on the gas side as the cost of being in the oil business,” he said.

Western Canada currently has an over supply problem, when it comes to natural gas. We actually have too much. “It’s just been in the last couple of years where we’ve seen a real oversupply,” Archer said. “We have lower demand, we have a little more production this year, and we have very full storage inventories in Western Canada.” Despite the current low prices, producers haven’t stopped drilling new wells in B.C. and Alberta, as producers anticipate a new market in Asia through LNG exports.

“There’s thinking that producers are getting ahead of LNG and bringing up production in the anticipation that once LNG Canada comes on it clears the market,” Archer said. “And what we’re finding is it’s just taking longer to clear the market than producers were hoping.”

So, yes, eventually LNG exports may lift natural gas prices. But gas prices here could easily triple, and it would still be cheap compared to most other regions in the world. “If similar levels of activity and associated production are maintained over the next five years, all added demand from LNG exports would be met and it could be argued prices could return to current levels,” Deloitte notes.

Canada is not Australia, which is a major LNG exporter.

My research assistant, Chat GPT, tells me that, after doing all the necessary conversions to bcf/d, Australia produces about 15.8 bcf/d of natural gas and exports 10.3 bcf/d. So it exports about 75% of the gas it produces. At full build-out of LNG Canada, Ksi Lisims, Cedar and Woodfibre LNG, we would still only be exporting about half as much LNG as the U.S. and Australia does.

So relax. Western Canada has oceans of natural gas that is easily exploited, at relatively low costs. As for the increases faced by northern B.C. residents, that’s a whole other story.