In pictures: click to see Russia China deal in perspective

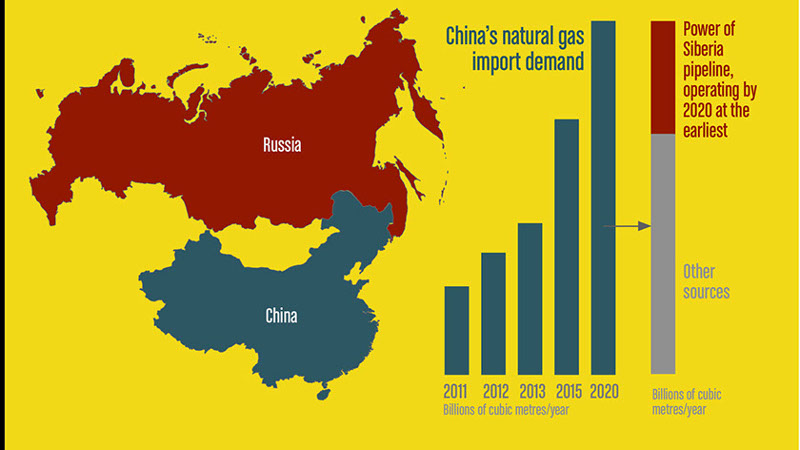

It is clear that between 2013 and 2020 China’s demand for gas imports will go from 53 billion cubic metres a day to 130. (The new “Power of Siberia” pipeline is not expected to begin supplying gas until about 2020.)

Experts estimated the deal sets a price on Siberian natural gas imports of just under $10 per thousand cubic feet. That is more than double the current spot price for North American gas ($4.48 on May 22, 2014) – a good deal for the seller, Russia and one that gives comfort to the buyer.

If the arrangement is for 30 years, that is double length of time of typical LNG contracts signed, for example, between Australia and Japan which are typically for 15 years.

The Chinese are paying for long-term price stability and in return the Russians get the long-term relief of being able to predict income far into the future.

Their situation is a lot like being a homebuyer, who can choose between a the risk of a floating mortgage based on today’s low rates, knowing the cost might shoot up in future, or locking into multi-year deal at a much higher, but stable, rate.

Clearly, the Chinese have chosen the security of a higher, stable price. Russia gains the ability to make long-term capital investments with the same stability at its end.

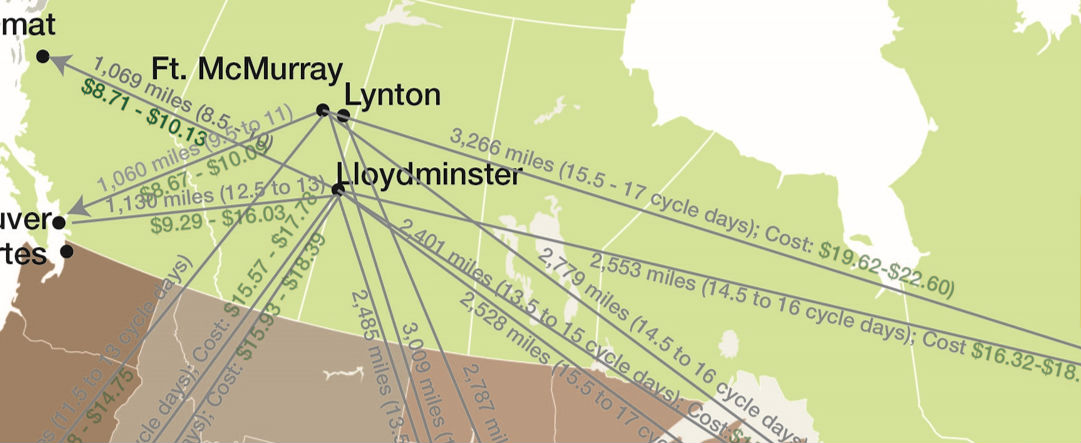

Most estimates indicate that profitability for British Columbia LNG projects requires a price greater than $10 per unit. Australian LNG producers have locked-in contracts with Japan in the $15 range. India is paying nearly $14. European markets have long-term contracts between $10 and $11.

So the new Russia deal shows that natural gas remains a highly valued commodity. Alone, it comes nowhere close to satisfying overall Chinese demand. As well, China is not the only Asian nation in need of natural gas. Predictions that the Power of Siberia deal means other foreign gas sellers like Canada can forget about the China market are not well supported by the available facts.

Stewart Muir is executive director of Resource Works.