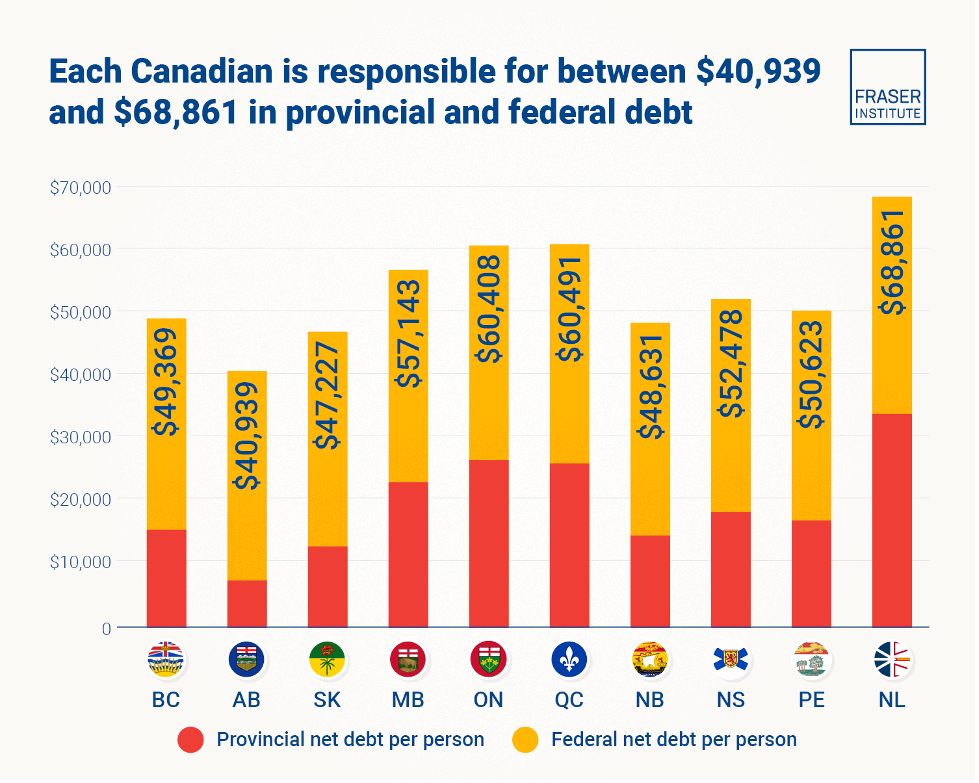

As government debt grows, we see numbers like this debated: Canada’s combined federal-provincial government debt is estimated to reach $2.3 trillion in 2025/26. And graphics such as this:

“Each Canadian is responsible.”

That’s from the small-c conservative Fraser Institute, which has long rung alarm bells about government debt, deficits, and continued borrowing. The institute says in a new commentary: “The last decade was a time of spending and borrowing in good and bad times alike, with the only constant in the corridors of government being how can we borrow more so we can spend even more.”

“COVID, and the government’s response to it, obviously increased spending and borrowing. However, federal spending did not return to pre-COVID levels after the pandemic. Instead, Ottawa ratcheted up spending and borrowing permanently post- COVID.”

The Canadian think tank’s prime messages:

- While Canada’s size of government is middle-of-the-pack, it saw the second-largest increase of any advanced economy during this period and the largest increase in the G7. This combined (federal and provincial) debt now equals 74.8% of the Canadian economy.

- Budget deficits and increasing debt have become serious fiscal challenges facing the federal and many provincial governments. Since 2007/08, combined federal and provincial net debt (inflation-adjusted) has nearly doubled from $1.21 trillion to a projected $2.30 trillion in 2024/25.

- Interest payments are a major consequence of debt accumulation. Governments must make interest payments on their debt similar to households that must pay interest on borrowing related to mortgages, vehicles, or credit-card spending. Revenues directed towards interest payments mean that in the future there will be less money available for tax cuts or government programs such as health care, education, and social services.

- The federal and provincial governments must develop long-term plans to meaningfully address the growing debt problem in Canada. The Fraser Institute is not alone, and Ottawa is not the only target. For example, Canadian economists Jock Finlayson and Ken Peacock write in Business in Vancouver: “B.C. is on track to run five consecutive operating deficits.”

“This year, total taxpayer-supported debt has already doubled compared to where it stood under former premier John Horgan. The plan outlined in Budget 2025 will see B.C.’s debt reach $166 billion, which will be a staggering $105 billion increase since (David) Eby became leader. “Stated plainly, the Eby government has taken a wrecking ball to British Columbia’s public finances.”

BC’s finance minister, Brenda Bailey, defended the deficit as necessary to respond to US tariffs and not cut essential public services. But the Royal Bank of Canada said BC’s plan doesn’t incorporate US tariffs into economic assumptions. RBC’s analysis said this of BC’s government finances:

- Significant risks threaten revenue and expenditure projections—the plan doesn’t incorporate U.S. tariffs into economic assumptions.

- But it increased the contingencies vote to $4 billion per year to add protection against unexpected expenses.

- Debt is forecast to soar 70% over the next three years.

- B.C.’s fiscal situation is on a deteriorating path even though it compares well to most other provinces. The Fraser Institute, among others, also hits governments for increasing hiring and boosting bureaucracy.

The Carney government recently initiated a spending review intended to find ‘ambitious’ internal savings before the 2025 fall budget. “As promised in the government’s election platform, this review will likely involve capping the size of the federal public service to find savings. However, rather than simply capping it, the government should shrink the size of the bureaucracy while also revisiting compensation levels.”

All in all, says the Fraser Institute: “The fiscal mismanagement of the last decade and the utter failure to keep our fiscal powder dry has placed Canadian government finances in a total mess.” And: “Now that the Trump tariffs have arrived, and Canada’s economy is weakening, government finances will weaken even further. This is a lesson for voters and governments alike—that it’s critical for long-term financial sustainability to keep the fiscal powder dry during good times, meaning spending restraint and debt reduction, to ensure governments have the resources needed for the next downturn.”

It also noted: “Among the provinces, Newfoundland & Labrador has the highest combined federal-provincial debt-to-GDP ratio (88.4 percent), while Alberta has the lowest (40.8 percent). Newfoundland and Labrador has the highest combined debt per person ($68,861), followed by Quebec ($60,491) and Ontario ($60,408). In contrast, Alberta has the lowest debt per person in the country with $40,939.

For BC, the think tank put out some new numbers:

- In its latest budget, the Eby government projected a record-breaking $10.9 billion deficit for this fiscal year 2025/26. Unfortunately, that’s just the tip of the iceberg.

- For starters, this projected budget deficit does not account for the effect of President Trump’s 25 per cent tariff on most Canadian goods (and 10 per cent tariff on energy products), which—according to the Eby government—will cost provincial coffers $1.4 billion annually, boosting the projected deficit to $12.3 billion.

- And then there’s the carbon tax. The Eby government effectively eliminated the consumer portion of the provincial carbon tax dropping the price to $0 effective April 1, 2025 (although B.C.’s carbon tax for industrial emitters will remain in effect). According to the government, this change will reduce provincial tax revenue by $2.0 billion this fiscal year, which increases the projected deficit further to a whopping $14.3 billion in 2025/26.

Some elders may recall that C.D. Howe, federal supply minister in the Second World War, when asked by the Opposition to cut $1 million from his budget estimates, supposedly sneered: “What’s a million?” Now, it seems, governments would respond with “What’s a billion?” The Fraser Institute reminds governments that “The basic idea is for governments to balance their budgets (or better yet, run surpluses) when the economy is growing, so resources are available when recessions hit.”

Yes, please.